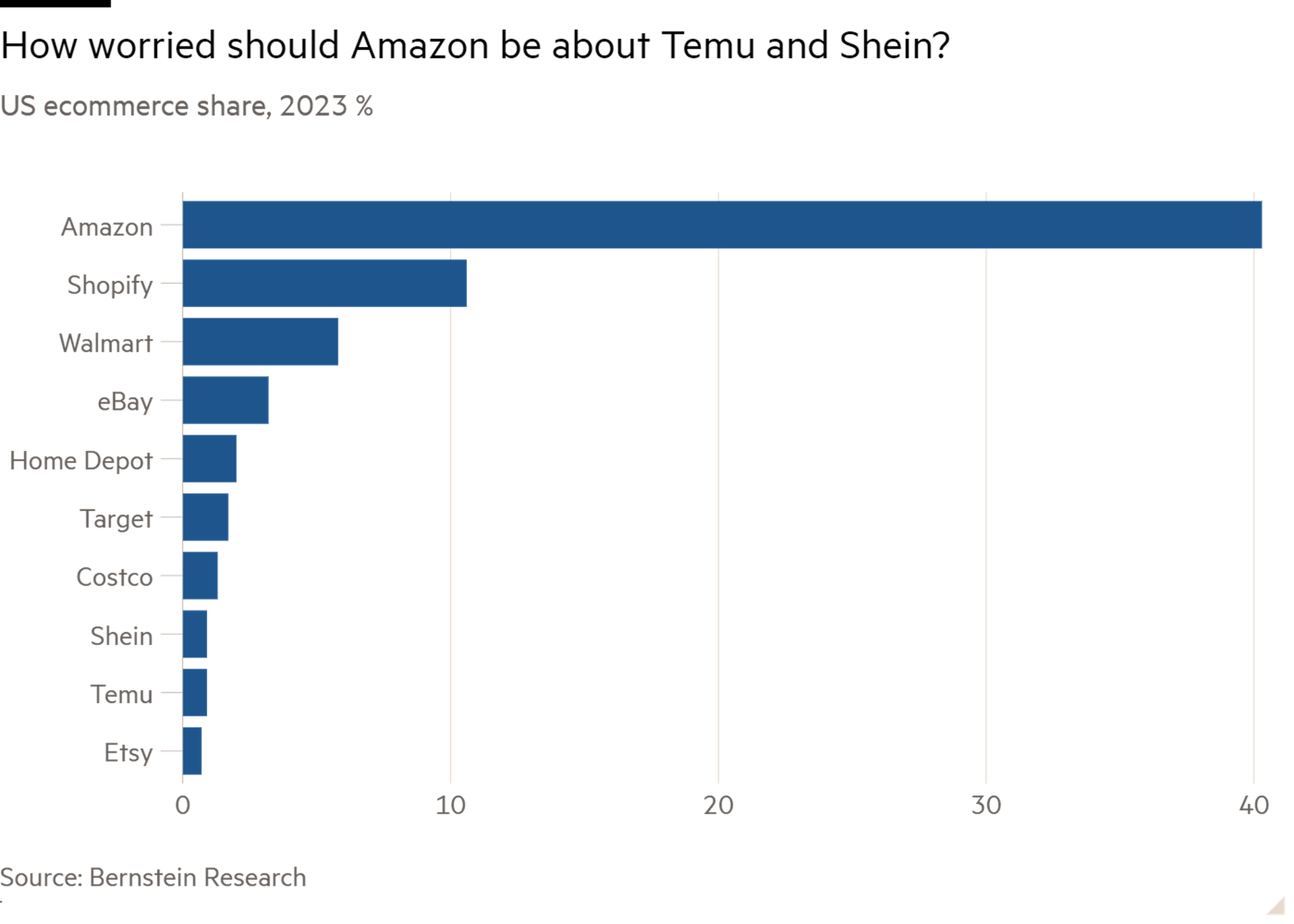

Amazon is no stranger to competition. From Walmart to Shopify, plenty of companies have tried to take on retail’s 800-pound gorilla. Few have emerged as a formidable challenger. Until now, with the explosive growth of Shein and Temu over the past two years.

Shein sells inexpensive but trendy clothing. Temu, whose products include household goods, apparel and toys, is more like a digital dollar store. The two have been able to undercut US rivals by delivering cheap goods to Americans straight from factories and warehouses in China.

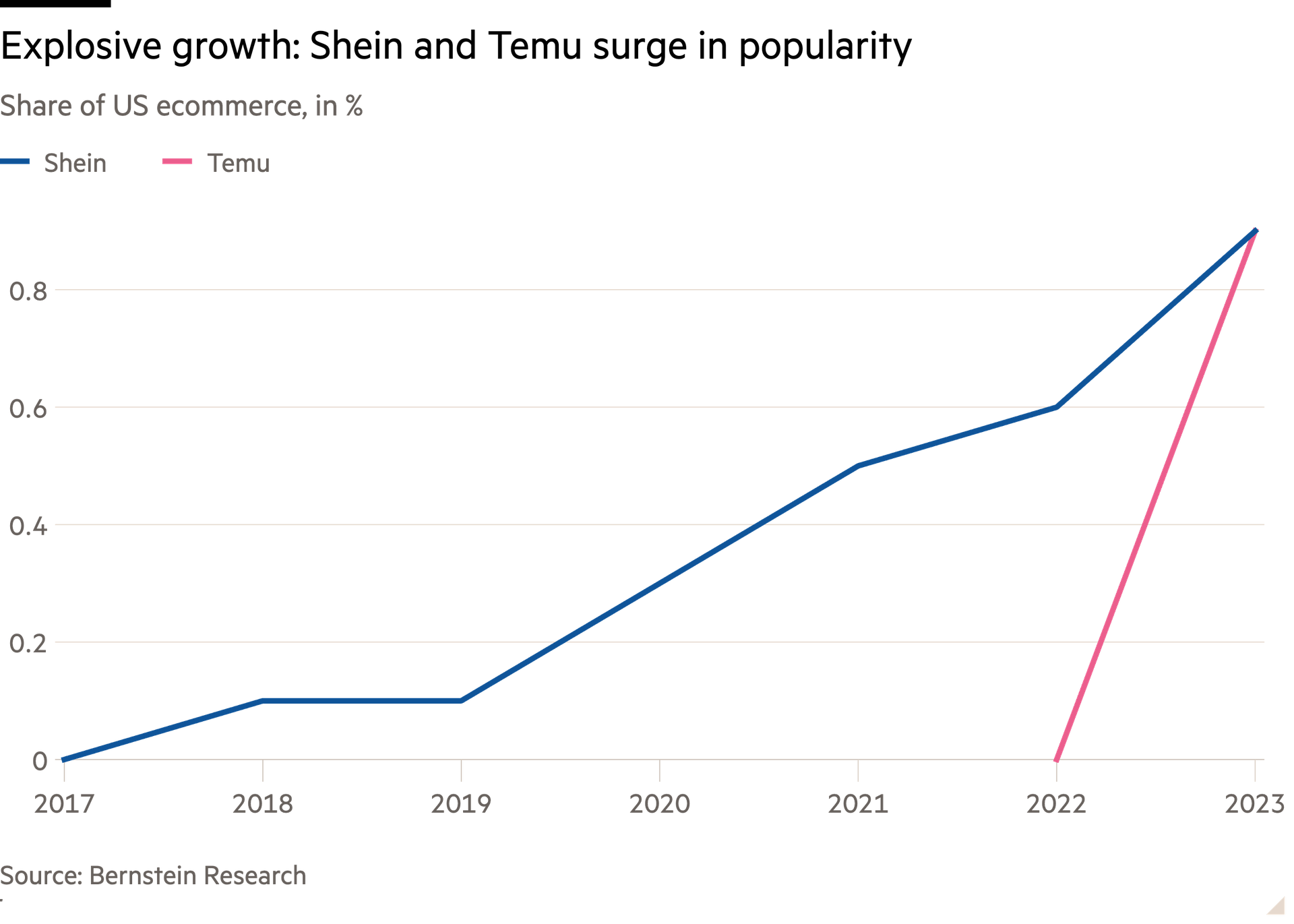

The pair’s rapid rise — each now commands a 1 per cent share of the US ecommerce market according to Bernstein Research — has forced Amazon to sit up and take notice. It defensively wants to emulate Shein’s and Temu’s low-cost business model with a direct-from-China discount marketplace of its own.

This seems a terrible idea. Since launching in the US in September 2022, Temu — powered by big ad spending — has shot to the top of the app stores. While parent company PDD Holdings does not break out Temu’s financial performance, Temu’s global gross merchandise value — the total of all goods sold — reached $17bn last year and could grow to $40bn this year, says Bernstein.

But that growth has come at a cost. Shipping $10 dresses from China to the US for free adds up. One estimate puts Temu’s cost of shipping and handling per package at around $11. Between that and the billions spent on marketing, Bernstein thinks Temu made an operating loss of $4.6bn last year. This does not look sustainable. Amazon, with its 40 per cent market share of the $1.1tn-a-year US ecommerce market, should sit back and watch Temu burn its money on user acquisition and logistics.

Moreover, while Amazon’s massive warehouse and logistics network in the US throws up serious barriers to entry to new rivals, it has a more modest presence in China. It will struggle to match Temu and Shein in terms of logistical efficiency over there. Amazon will also have to compete against the pair in attracting a large low-cost merchant base from which to source goods.

Then there are regulatory hurdles to consider. Regulators in Europe and the US are looking to crack down on the “de minimis” rule that has allowed Temu and Shein to send (in small scale) cheap goods overseas tariff free. This makes the timing of Amazon’s new direct from China venture odd. With Amazon facing antitrust lawsuits on both sides of the Atlantic, better to let Temu and Shein flame out in a bid for market share rather than join them in a race to the bottom.